"Yes, high-income people pay the bulk of the federal income tax. But that’s not the only tax! And while the income tax is quite progressive, the payroll tax — the other major federal tax — isn’t; and state and local taxes are strongly regressive."And he links to a .pdf of analysis by Citizens for Tax Justice, that is well worth reading. They say:

It’s true that the very rich pay a large share of federal income taxes, and that many taxpayers are too poor to owe any federal income taxes. But federal income taxes are only part of the picture. Other types of taxes, like federal payroll taxes, federal excise taxes, and state and localtaxes are regressive, meaning they take a larger share of income from a poor or middle-class family than they take from a rich family.

This fact seems to ring very true to me on the ground. While living in Arizona the last few years I was stricken by the high taxes I was paying, all the while state public services were being severely cut.

___________________________________________________

Original Post:Yesterday of course was that day that comes every year when tax returns are due. If you happened to tune into a right-wing radio show or Fox News, inevitably you heard some of the rightieys complaining that the problem is not that the rich don't pay their fair share, but that 45% of Americans allegedly pay little or no income taxes at all. I myself heard this on Limbaugh, Hannity and a local righty radio show.

And they weren't talking about the corporations like GE or wealthy individuals with paid accountants who figure out a way to not pay any taxes. Noooo, they were referring to the lucky many who are in the lower income distribution and make so little money that they slipped under the tax paying bar. Mitt Romney, being interviewed by Hannity, lamented that many of those Americans surely would like to pay some taxes to support our military. This seemed like a coy way of suggesting that we raise taxes on low income people so they indeed could help support our military, as if the blood and psychological health of their sons and daughters was not enough.

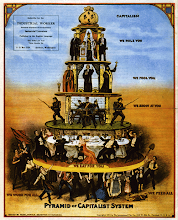

I admit it, this just is not fair for the rich! So I propose a simple solution. The owners of profitable businesses, CEOs, and the management of corporations, the people who comprise "the rich" should start paying better wages and benefits to those at the bottom of the income distribution. This way, those lucky non-tax payers would then have the income to start paying taxes, while at the same time the rich would pay less of the tax burden as they would be appropriating less of the social surplus in profits. There, problem solved!

Righties also have other complaints about the taxes and the tax system. See Michael Perelman's blog on Arthur Laffer's complaint.

No comments:

Post a Comment